CFO Message

for enabling sustainable growth

as a global company

CFO (Chief Financial Officer)

Masaaki Yamamoto

An urgent task for achieving the NTN Revitalization Scenario is to realign our automotive business. We have set a target of eliminating the operating loss in the fiscal year ending March 31, 2024, by thoroughly passing on inflationary costs to sales prices, reducing variable costs through procurement reforms, and continuing to control fixed costs.

Actual results for the fiscal year ended March 31, 2023, and forecast for the fiscal year ending March 31, 2024

Actual results for the fiscal year ended March 31, 2023

1. Key points

For the fiscal year ended March 31, 2023, net sales were 774.0 billion yen (up 20.6% year on year), operating income was 17.1 billion yen (up 149.2%), ordinary income was 12.0 billion yen (up 76.8%), and profit attributable to owners of parent was 10.4 billion yen (up 41.2%). However, compared with the forecasts announced in October 2022, operating income fell short by 34.2%, ordinary income was 47.6% lower, and profit attributable to owners of parent was 13.6% lower. The shortfall in profits compared with our forecasts was mainly due to production adjustments made in the fourth quarter with a focus on cash flow in anticipation of a delay in the recovery of demand from automotive customers; an additional rise in variable costs, including accepting price increases from suppliers; and also to insufficient progress on raising our sales prices. On the other hand, we controlled fixed costs amid fluctuating sales and improved both free cash flow and our net D/E ratio. By steadily carrying out various measures, we met our announced targets in these areas.

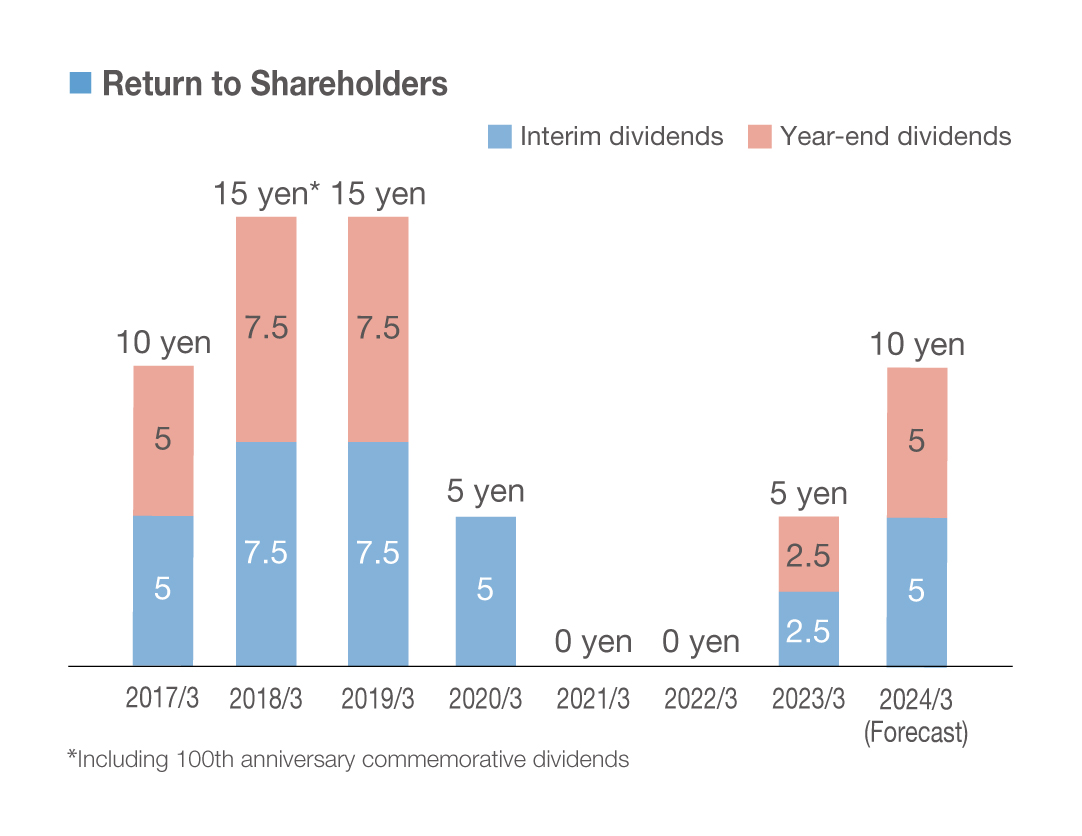

In terms of profit/loss by business segment, the automotive business suffered severe results, continuing to post an operating loss for the fourth consecutive fiscal year. This was mainly due to additional increases in variable costs, failure to raise sales prices, and lockdowns that affected the high-margin Chinese business. In contrast, the aftermarket business and industrial machinery business each posted record-high operating income, achieving the operating margin targets set in the Medium-term Management Plan "DRIVE NTN100" Phase 2 one year ahead of schedule. We have resumed dividend payments for the first time in three fiscal years, paying an annual dividend of 5 yen per share.

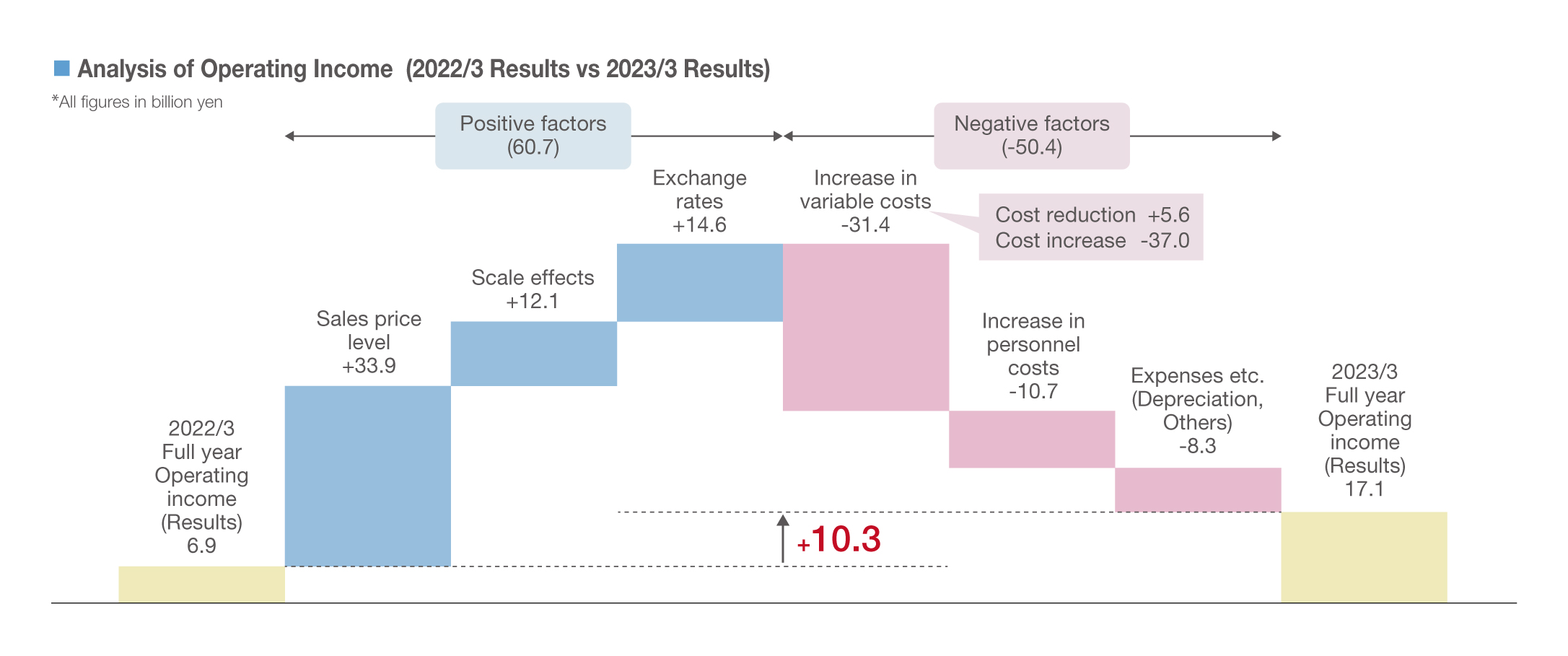

2. Profit Analysis (year on year)

Breakdown of positive factors (60.7 billion yen)

The largest positive factor is the sales price level, accounting for 33.9 billion yen. We worked to pass on to our customers the higher steel prices as well as other inflationary cost increases such as higher variable costs and higher ocean freight rates. However, we did not meet some of our targets, mainly for our automotive customers. The scale effects of 12.1 billion yen arose from the impact of higher sales and production (9.9 billion yen), inventory valuation, and other factors. Adding the impact of exchange rates of 14.6 billion yen to this total, the positive factors amounted to 60.7 billion yen.

Breakdown of negative factors (50.4 billion yen)

In variable costs, we carried out cost reductions of 5.6 billion yen, including procurement reforms, in response to the 37.0 billion yen in price hikes of various materials including energy prices, resulting in a negative factor of 31.4 billion yen. Recently, compared to the 37.0 billion yen of cost increases in the previous fiscal year, the pace of steel price increases in particular has calmed down, but inflationary costs continue to rise.

In fixed costs, personnel costs increased by 10.7 billion yen, and expenses etc. rose by 8.3 billion yen, amounting to a negative factor of 19.0 billion yen. The increase in personnel expenses was mainly due to a 6.0 billion yen increase in the Americas due to special factors such as higher labor costs and disruptions in production. In terms of expenses and other costs, there were special factors such as a 7.5 billion yen increase in transportation costs mainly due to soaring ocean freight rates and a 1.8 billion yen increase in depreciation costs associated with the full-scale operation of IT core systems in Japan. Excluding these special factors, the increase in fixed costs was 3.7 billion yen, less than 15% of the 26.8 billion yen increase in volume-based sales.

■Analysis of Operating Income (2022/3 Results vs 2023/3 Results)

Forecast for the fiscal year ending March 31, 2024

1. Key points

Continuing on from the previous fiscal year, the key issues for the fiscal year ending March 31, 2024, will be to strongly drive the transfer of inflation costs to sales prices, and to steadily reduce variable costs, including procurement reforms and control fixed costs. Looking at the year ahead by business segment, it will be essential to maintain operating margins in the industrial machinery business, where sales volume is down from the previous year, and in the aftermarket business, where sales volume is flat. We must also eliminate operating losses in the automotive business, where we expect sales volume to grow as the semiconductor shortage eases, by both responding to increased production and implementing the above key issues. In addition, as a medium- to long-term initiative for enhancing the profitability of the automotive business, we plan to carry out a realignment of our organization and production, mainly in Europe and the Americas. For the fiscal year ending March 31, 2024, after factoring in some losses from restructuring and other factors, we project net sales of 810 billion yen, operating income of 30 billion yen, extraordinary losses of 4 billion yen, and profit attributable to owners of parent of 11 billion yen. The Company plans to pay an annual dividend of 10 yen per share.

■Return to Shareholders

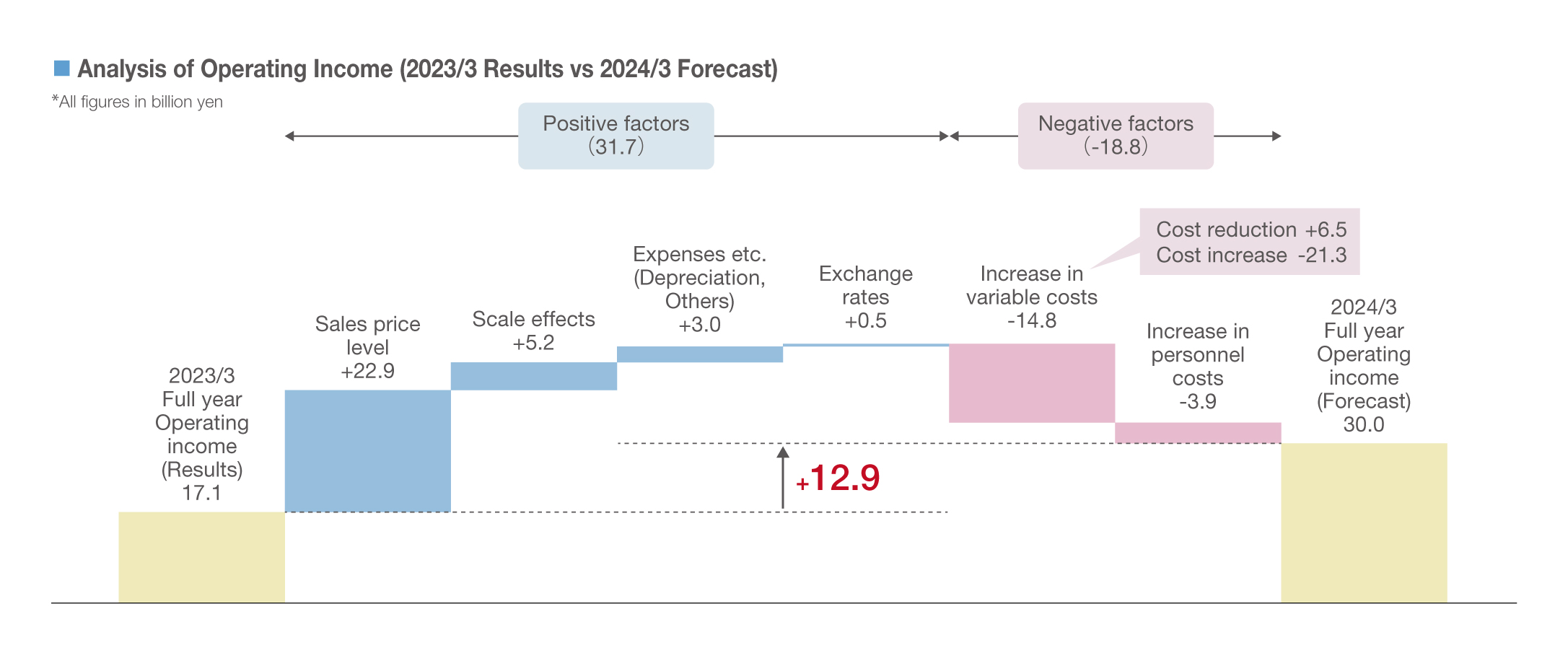

2. Profit Analysis (year on year)

Breakdown of positive factors (31.7 billion yen)

The largest positive factor, in keeping with the previous year, is sales price levels, amounting to 22.9 billion yen. Scale effects are expected to be limited to 5.2 billion yen as a result of a conservative estimate of the impact of inventory reductions and of a deteriorating product mix as a result of higher ratio of automotive business. Although we expect an increase in expenses due to the increase in scale effects, we anticipate total expenses to decrease by 3.0 billion yen as marine transportation costs, which rose sharply in the previous fiscal year, begin to decline. This, together with a 0.5 billion yen impact from exchange rates, is expected to result in positive factors of 31.7 billion yen.

Breakdown of negative factors (18.8 billion yen)

In variable costs, we plan to carry out cost reductions of 6.5 billion yen, including procurement reforms, in response to 21.3 billion yen in price hikes of various materials including energy prices, resulting in a negative factor of 14.8 billion yen. Although the pace of steel price increases in particular has eased compared to the 37.0 billion yen of cost increases in the previous year, inflationary costs continue to rise.

As for fixed costs, we expect personnel expenses to lead to a negative factor of 3.9 billion yen. Labor costs are likely to increase mainly in Japan (1.4 billion yen) and Europe (1.6 billion yen) due to rising prices and other factors. In the Americas, however, where labor costs rose in the previous fiscal year due to soaring labor costs and production disruptions, we expect these cost increases to ease. The increase in fixed costs, which includes a 3.9 billion yen increase in personnel expenses and a 1.9 billion yen increase in expenses and other items excluding transportation costs, is set at 5.8 billion yen. This is based on our existing standard of limiting the increase to within 15% (6 billion yen) of the 40.1 billion yen increase in sales volume.

■Analysis of Operating Income (2023/3 Results vs 2024/3 Forecast)

3. Comparison with Medium-term Management Plan targets

The fiscal year ending March 31, 2024, will be the final year our Medium-term Management Plan "DRIVE NTN100" Phase 2, aimed at strengthening our financial position. The business environment has changed drastically since we formulated the Medium-term Management Plan. This was mainly due to the situation in Ukraine as well as the economic slowdown in China stemming from lockdowns in response to the re-emergence of COVID-19. Prices of raw materials, energy, and other materials have soared. Prolonged semiconductor supply shortages have slowed the resumption of automotive production.

Despite these difficult conditions, we expect to meet the operating margin targets in the Medium-team Management Plan for the aftermarket business and for the industrial machinery business. However, we will not be able to achieve the operating margin target in the Medium-term Management Plan for the automotive business. This is due to the impact of soaring materials prices which continue to bring costs that we will have to pass on to sales prices.

Although we will not achieve our operating margin targets for the entire company due to the automotive business, whose sales volumes are large, we have been steadily improving our financial position through steady recovery of our performance each fiscal year, as well as the sale of idle assets, and robust financial management within the Group. As a result, we expect to achieve the Medium-term Management Plan targets for free cash flow, equity ratio, and net D/E ratio.

Although some of the goals set in the Medium-term Management Plan, such as ROIC of 5% and ROE of 8%, will be pushed back to the next fiscal year and beyond, we will continue our management to strive for corporate value creation.

■Comparison with Medium-term Management Plan target

| 2021/3 Results |

DRIVE NTN100 Phase2 ① |

2023/3 Results |

2024/3 Forecast② |

② - ① | |

|---|---|---|---|---|---|

| Net sales | 562.8 billion | 700.0 billion or more | 774.0 billion | 810.0 billion | 110.0 billion |

| Operating income | -3.1 billion | 42.0 billion or more | 17.1 billion | 30.0 billion | -12.0 billion |

| Operating margin | -0.6% | 6% or more | 2.2% | 3.7% | -2.3pt |

| (Aftermarket) | 9.7% | 12.0% | 16.6% | 16.9% | +4.9pt |

| (Industrial machinery) | 0.3% | 4.0% | 5.2% | 5.6% | +1.6pt |

| (Automotive) | -3.4% | 4.7% | -2.5% | 0.0% | -4.7pt |

| FCF | 18.5 billion | 27.0 billion or more | 20.4 billion | 29.0 billion | 2.0 billion |

| Inventory turnover ratio | 3.2 | 4.1 | 3.2 | 3.7 | -0.4 |

| Equity to capital ratio | 20.4% | 20% or more | 25.4% | 25.8% | +5.8pt |

| Net D/E ratio | 1.6 | 1.5 or less | 1.2 | 1.1 | -0.4 |

| ROIC | -0.4% | 5% or more | 2.0% | 3.6% | -1.4pt |

| ROE | -7.1% | 8% or more | 5.0% | 5.0% | -3.0pt |

Toward medium-to long-term growth

Our current Medium-term Management Plan ends in the fiscal year ending March 31, 2024, and the next three-year medium-term management plan will start from April 2024. Ahead of this, we carried out an organizational reform in April of this year with the aim of enhancing the strategic functions of the head office division. In the head office division, we will transform ourselves into an organization that can contribute to the business activities of the entire group. We will do this by enhancing our ability to formulate the head office and business divisions are in talks aimed at drawing up the next medium-term management plan. The next medium-term management plan will continue the measures set forth in the current Medium-term Management Plan. These include lowering the break-even point for sales (product/business portfolio reform, procurement reform, fixed cost control) and expanding cash flow (production and logistics reform). While we will not be able to achieve our medium-term management targets for ROIC of 5% and ROE of 8%, we will work to achieve these at the earliest possible date. In addition, we will steadily promote structural reforms such as realigning our production as we work to further strengthen our financial position.

In addition, we plan to set and disclose targets for non-financial indicators such as promoting carbon neutrality and investing in human resources (human capitalism). We aim to increase corporate value by steadily improving our financial strength and non-financial indicators, and to achieve a P/B ratio of greater than 1 by engaging with investors to gain the appreciation of the stock market. I would like to thank all of our stakeholders for their continued support, guidance and encouragement.