Corporate Governance

※The contents are based on “NTN Report 2023.”

Basic Approach and Implementation System

Basic approach

Strengthening and enhancing our corporate governance is one of our top management priorities. We take steps to make management more efficient and robust while working to increase management transparency by disclosing information to shareholders and investors in a prompt and accurate manner.

We made a transition from a Company with a Board of Company Auditors to a Company with a Nominating Committee, etc. in June 2019 with the aim of establishing a prompt decision-making structure and operational execution organization, strengthening the supervision of management, and improving management transparency and fairness. Under this structure, we will work on further improvement of corporate value over the medium- and long-term.

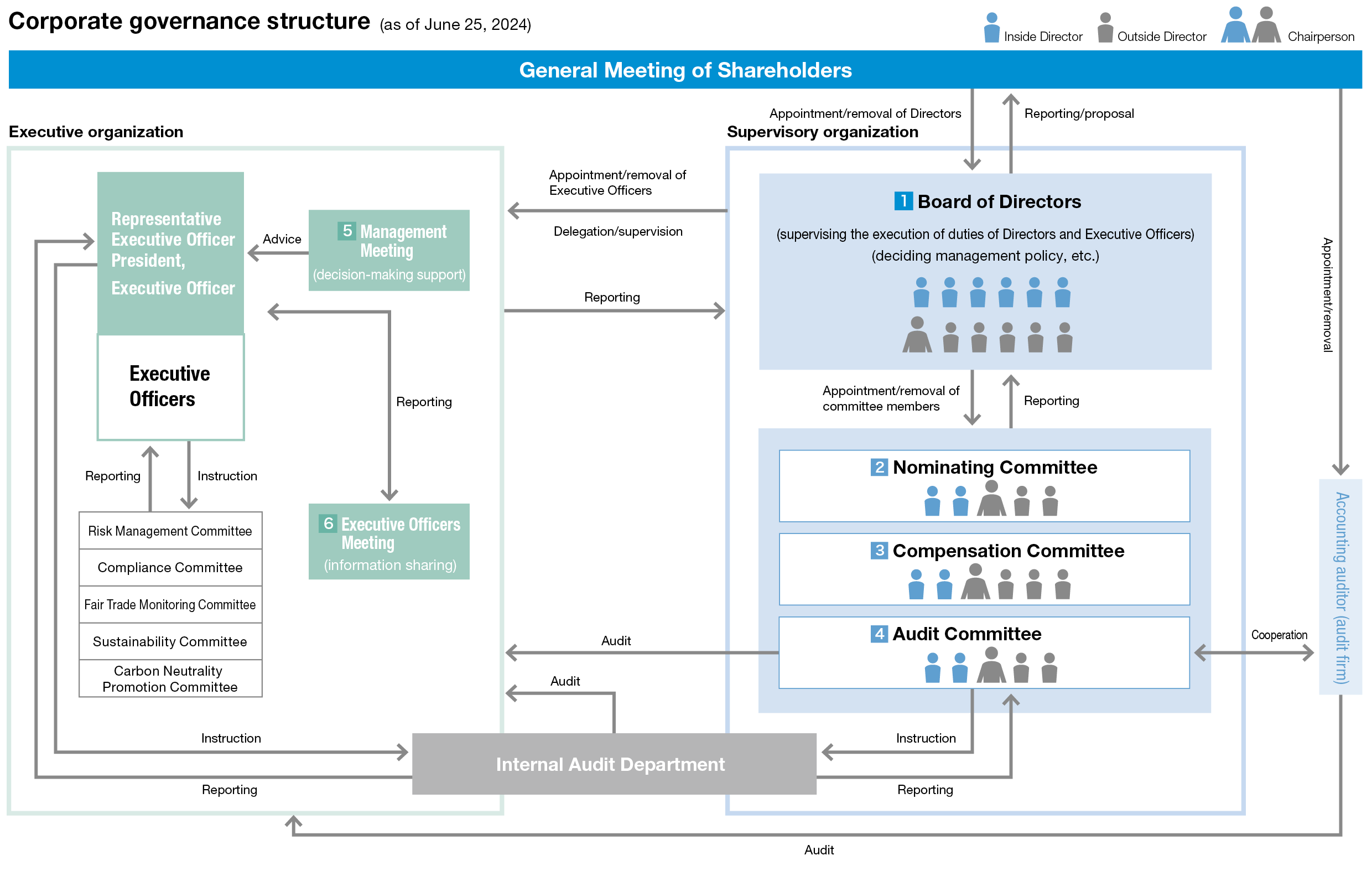

■Corporate governance structure (as of June 27, 2023)

Board of Directors

The Board of Directors decides the basic management policies, and supervises the execution of duties of Directors and Executive Officers. Except matters stipulated by laws and regulations or the Articles of Incorporation to be resolved at the Board of Directors, the Board of Directors delegated substantial authority to Executive Officers with the aim to strengthen the supervision of management, and make decisions more promptly.

The Board of Directors is held once a month in principle, but it is also held flexibly as needed.

The Articles of Incorporation specify that the term of office of Directors shall be one year, and the number of Directors shall be within 15.

The number of Directors is 11 as of June 27, 2023, and five of them are Outside Directors. The Board of Directors is chaired by an Outside Director.

Nominating Committee

The Nominating Committee decides on the content of a proposal regarding appointment/ removal of Directors, which is submitted to the General Meeting of Shareholders. The number of members is five as of June 27, 2023, and three of them are Outside Directors. The committee is chaired by an Outside Director.

Compensation Committee

The Compensation Committee decides on the policy for determining details of compensation for Directors and Executive Officers, and determines details of compensation for individual persons. The number of members is five as of June 27, 2023, and three of them are Outside Directors. The committee is chaired by an Outside Director.

Audit Committee

The Audit Committee audits the execution of duties of Directors and Executive Officers, and decides on the content of a proposal regarding appointment/removal of the accounting auditor, which is submitted to the General Meeting of Shareholders. The duties of the Audit Committee are supported by the Internal Audit Department, and the Secretariat of Audit Committee, etc. are staffed by persons holding different posts as well. These persons, who have proper capacity and experience for supporting the Audit Committee, are appointed by the manager of the Internal Audit Department, with the approval from the Internal Audit Committee. Regarding matters related to personal relocation, disciplinary punishment, evaluation, etc. of such persons, the approval from the Audit Committee shall be required for decision.

The number of members is four as of June 27, 2023, and three of them are Outside Directors. The committee is chaired by an Outside Director.

Management Meeting

The Management Meeting discusses important matters relating to operational execution, as a supporting body for decision making of President, Executive Officer. The meeting is composed of President, Executive Officer, and Executive Officers who are designated by him, and held twice a month in principle.

Executive Officers Meeting

The Executive Officers Meeting is held by President, Executive Officer under the attendance of all Executive Officers. Matters resolved at the Board of Directors are instructed, and each Executive Officer reports about the status of operational execution. This meeting is held once a month in principle, to make operational execution more efficient and effective by sharing information among Executive Officers.

Directors

Executive Officers

Responsibilities of Executive Officers (as of April 1, 2023)

| Name | Position | Assignments |

|---|---|---|

| Eiichi Ukai |

Representative Executive Officer, President, Executive Officer |

CEO (Chief Executive Officer) Corporate General Manager, Group Management HQ. |

| Hideaki Miyazawa |

Representative Executive Officer, Executive Officer |

Corporate General Manager, Automotive Business HQ. |

| Hiroyuki Ichikawa | Executive Officer |

Deputy Corporate General Manager, Automotive Business HQ. Composite Material Product Division |

| Masaki Egami | Executive Officer |

CTO (Chief Technology Officer) Research Division New Product & Business Strategic Planning HQ. |

| Takanobu Ozawa | Executive Officer |

Americas Region Legal Dept. Internal Control Dept. |

| Masayuki Kaimi | Executive Officer |

Corporate General Manager, SCM Strategy HQ. China Region Production Engineering Development HQ. |

| Yasuhiro Kawabata | Executive Officer |

Deputy Corporate General Manager, Group Management HQ. Human Resources Strategy Dept. Personnel Dept. General Affairs Dept. |

| Shumpei Kinoshita | Executive Officer |

Deputy Corporate General Manager, Group Management HQ. Corporate Strategy Dept. ESG Promotion Dept. Carbon Neutrality Strategy Promotion Dept. |

| Koji Takahashi | Executive Officer |

Green Energy Products Division ICT Strategy Dept. |

| Etsu Harima | Executive Officer |

Aftermarket Business HQ. Industrial Business HQ. Quality Assurance HQ. NTN KOREA CO., LTD. ASEAN, Oceania, and West Asia Region India Region |

| Masaaki Yamamoto | Executive Officer |

CFO (Chief Financial Officer) Deputy Corporate General Manager, Group Management HQ. Financial Strategy Dept. Accounting Dept. Europe & Africa Region |

The appointment of Executive Officers

The appointment of Executive Officers shall be determined after careful deliberation by the Board of Directors, comprehensively considering whether they possess personalities, insights, capabilities, experience/performance, etc. that are appropriate for fulfilling their duties. In addition, if it becomes clear that an Executive Officer lacks the required qualifications, he/she will be promptly dismissed by the Board of Directors.

Flattening of the system and compensation

On June 25, 2021, the Company removed the Managing Executive Officers and eliminated hierarchical relationships among Executive Officers and made them one team. It enables all Executive Officers to activate discussions and respond to various issues quickly toward further enhancement of its corporate value.

In line with the flattening of the system, in April 2022 we abolished the conventional system of compensation by position and shifted to a system of compensation for Executive Officers based on the responsibilities of the division to which they are in charge.

Introduction of ESG evaluation

Since April 2022, ESG items have been set as key individual target measures for Executive Officers involved in the calculation of annual incentives (bonuses). The degree of achievement of these ESG items is one of the evaluation indicators. By introducing ESG items into the evaluation system, Executive Officers are promoting active ESG initiatives.

Governance-strengthening transition

|

2004 |

|

|---|---|

|

2006 |

|

|

2008 |

|

|

2011 |

|

|

2012 |

|

|

2015 |

|

|

2016 |

|

|

2018 |

|

|

2019 |

|

|

2020 |

|

|

2021 |

|

|

2022 |

|

Board of Directors

Approach of Board of Directors

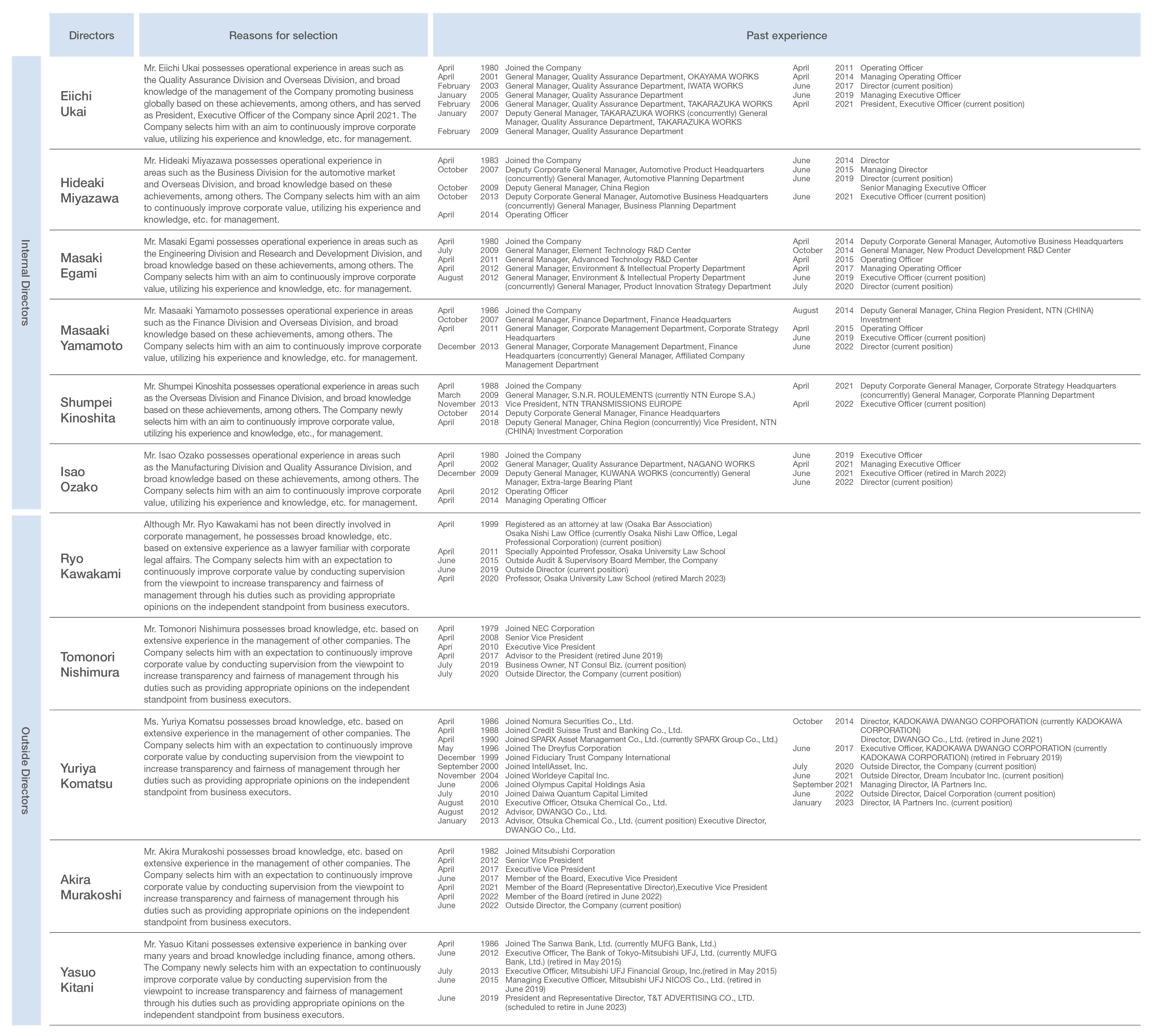

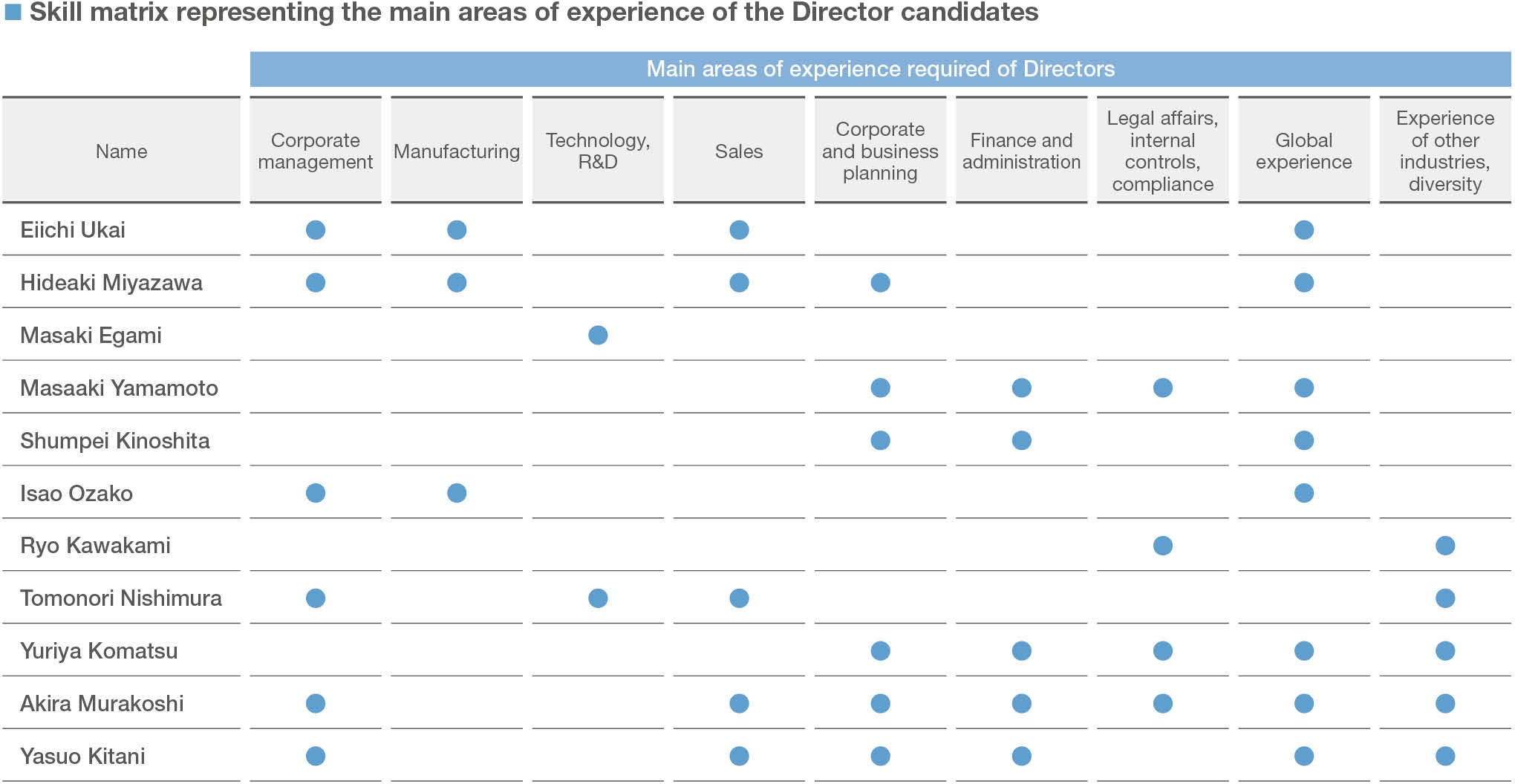

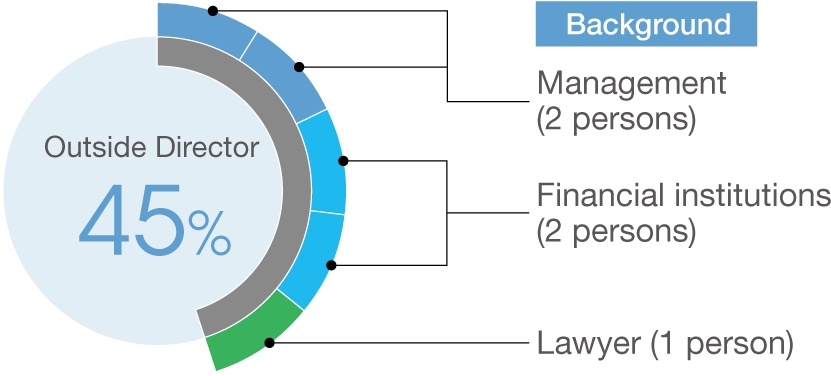

Directors other than Outside Directors are appointed from a wide range of fields, including manufacturing, marketing, technology, and administrative divisions. In addition, Outside Directors are appointed after considering diversity and balance, such as being a person with knowledge of finance, experienced management, and being a lawyer. We believe that the current number of Directors is an appropriate size for strengthening corporate governance and expanding our global businesses.

Diversity of Directors

Upon the approval of the General Meeting of Shareholders in the fiscal year ended March 2020, a female Director (Outside Director) was newly appointed for the first time at the Company. The female Director with experience in a different industry than ours supervises management. This will enable us to integrate diverse values and accelerate transformation aimed at achieving sustainable growth.

Assessment of effectiveness of the Board of Directors

We annually evaluate the effectiveness of the Board of Directors to improve the effectiveness. In the fiscal year ended March 31, 2023, we conducted a self-assessment of the Board of Directors by sending out questionnaires to Directors from the viewpoints such as role/structure/management of the Board of Directors and management of committees. Although this evaluation was generally positive, it was mentioned, regarding the performance evaluation of Executive Officers, that the target management system has been developed, but its operation is still in the developing stage. There was also another comment on reverification of matters resolved at the Board of Directors. On these matters, we have decided to continue discussion. We will continue to analyze and evaluate the effectiveness of the Board of Directors on a regular basis to make improvements.

The main areas of experience of Directors (Skill matrix)

Nominating Committee

Members, the number of meetings, and attendance

(from April 1, 2022 to March 31, 2023)

| Name | Title | Attendance | Number of attendances |

|---|---|---|---|

| Noboru Tsuda | Chairperson Outside Director |

100% | 5 times/5 times |

| Kouji Kawahara | Outside Director | 100% | 5 times/5 times |

| Akira Murakoshi | Outside Director | 100% | 5 times/5 times |

| Eiichi Ukai | Director | 100% | 5 times/5 times |

| Isao Ozako | Director | 100% | 5 times/5 times |

Discussions on Nominating Committee

The committee was held five times for the year ended March 31, 2023, with discussions mainly on the follow up on the business execution plans of Executive Officers, the structure of officers for the fiscal year ending March 31, 2024, and the selection of candidates for President, Executive Officer, Representative Executive Officers and Executive Officers and Directors.

About Outside Directors

As of June 27, 2023, the Board of Directors consists of 11 members, including six Inside Directors and five Outside Directors, and the ratio of Outside Directors is 45%. We will continue to strengthen the supervision of management and improve management transparency and fairness. In addition, in order to ensure appropriate corporate governance, we have established our own standards regarding the independence of Outside Directors, stipulating qualification and independence standards for them. These standards are used for appointing Outside Directors. Also, all of the Outside Directors are designated as Independent Officers as defined by the rules of the Tokyo Stock Exchange, Inc. (TSE), and are reported to TES as such.

For Outside Directors, we have established an environment where active discussions can be held at the Board of Directors through actions such as explaining the issues as necessary by secretariat and others prior to a relevant meeting of the Board of Directors. Moreover, we continuously provide information necessary to effectively fulfill the roles and responsibilities of an Outside Director by creating opportunities to deepen their understanding of our business through on-site inspection of business sites and other means.

Standards for Selection of Directors

Candidates for Directors will be selected from inside and outside the Company based on standards for selection of Directors as described below, considering the diversity and balance of the Board of Directors (including gender and internationality), after careful deliberation by the Nomination Committee.

- Must be in good condition both physically and mentally.

- Must have a high sense of ethics and a law-abiding spirit.

- Must be able to engage in constructive discussion from an objective viewpoint.

- Must be highly motivated to improve their abilities.

- Must have excellent decision-making skills from a company-wide and medium- to long-term perspective.

- Must have excellent insight and foresight concerning changes to the overall environment and to society.

- Must have sufficient record of performance and expertise in relevant fields. (Corporate manager or expertise)

- Outside Directors must (1) have sufficient time to accomplish their duties, (2) satisfy the standards regarding the independence of Outside Directors, (3) ensure diversity between the Outside Directors, and (4) have the requisite abilities to accomplish duties as a member of any of the three Committees.

The appointment of Executive Officers

The appointment of Executive Officers shall be determined after careful deliberation by the Board of Directors, comprehensively considering whether they possess personalities, insights, capabilities, experience/performance, etc. that are appropriate for fulfilling their duties. In addition, if it becomes clear that an Executive Officer lacks the required qualifications, he/she will be promptly dismissed by the Board of Directors.

On June 25, 2021, the Company removed the managing Executive Officers and eliminated hierarchical relationships among Executive Officers and made them one team. It enables all Executive Officers to activate discussions and respond to various issues quickly toward further enhancement of its corporate value.

Compensation Committee

Members, the number of meetings, and attendance

(from April 1, 2022 to March 31, 2023)

| Name | Title | Attendance | Number of attendances |

|---|---|---|---|

| Tomonori Nishimura* | Chairperson Outside Director |

100% | 6 times/6 times |

| Ryo Kawakami | Outside Director | 100% | 7 times/7 times |

| Yuriya Komatsu | Outside Director | 100% | 7 times/7 times |

| Eiichi Ukai | Director | 100% | 7 times/7 times |

| Masaaki Yamamoto* | Director | 100% | 6 times/6 times |

*The number of attendances after becoming as a member of the Committee

Discussions at the Compensation Committee

The Compensation Committee was held seven times from April 2022 to March 2023.

The Compensation Committee aims to improve fairness, transparency, and objectivity of procedures regarding the decision making of compensation for Directors and Executive Officers and enhance corporate governance. Also, the committee passed resolutions regarding the details of compensation (such as compensation specified for each individual) of Officers.

■Compensation Committee (from April 1, 2022 to March 31, 2023)

|

1st |

Points granted by BIP Trust for compensation of Officers Bonus for Executive Officers in 2022 |

|---|---|

|

2nd |

Decision of the order of substitution for the chairperson in the event of an accident Basic policy for determination of compensation Director compensation Changes in compensation for Executive Officers due to organizational change Compensation Committee’s annual activity plans |

|

3rd |

Executive Officer’s business execution plans |

|

4th |

Review of compensation levels and compensation structure of Officers Winter bonus for Operating Officers |

|

5th |

Punishment of Executive Officer |

|

6th |

Executive Officer compensation |

|

7th |

Basic compensation for Executive Officers Executive Officer compensation Revision of stock issuance regulations and internal regulations |

Basic policy for determining compensation

The system and level of compensation for Officers, compensation specified for each individual, etc. are determined in the Compensation Committee chaired by an Outside Director using objective information including the level and trends of other companies as reference.

Compensation for Executive Officers and compensation for Directors are determined separately, and if a Director also serves as an Executive Officer, those compensations are added up.

Compensation for Executive Officers

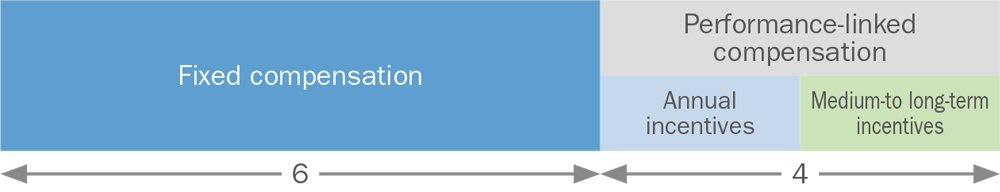

Compensation for Executive Officers consists of fixed compensation and performance-linked compensation, which fluctuates according to performance. The ratio of fixed compensation to performance-linked compensation is approximately 6:4 as a standard.

Fixed compensation consists of basic compensation, compensation by responsibility and compensation by representation.

■Annual incentives

For Executive Officers, the Company determines whether or not to provide payment of monetary compensation that reflects the performance of a single fiscal year, based on consolidated financial results indicators, etc. of the previous fiscal year and, in the case of providing such payment, the total amount. The payment or non-payment of each Executive Officer, and in the case of payment, the amount, is determined within the total amount of provision by considering the Executive Officer’s progress on priority target measures. Indicators related to the calculation of bonuses are based on consolidated financial results: net sales, operating income and net income from the perspective of emphasizing the achievement of earnings growth. The provision is made once a year in June after the determination of the Compensation Committee.

■Medium- to long-term incentives

Company’s shares shall be issued based on the achievement level of major target figures in the Medium-term Management Plan (money equivalent to the converted amount of shares shall be paid for a certain portion) as incentives to motivate them to achieve the targets in the Medium-term Management Plan and contribute to raising shareholder value, and in order to promote the holding of the Company’s shares. Medium- to long-term performance targets include key performance indicators (consolidated operating margin, consolidated net sales, etc.) that take into account the Company’s management policies.

Compensation for Directors

Compensation for a Director consists only of fixed compensation.

Fixed compensation shall be calculated by increasing basic compensation (which is determined based on his/her concurrent duties as an Executive Officer and whether he/she works full-time or part-time), taking into account a committee to which a Director belongs and his/her role at the committee.

Audit Committee

Members, the number of meetings, and attendance

(from April 1, 2022 to March 31, 2023)

| Name | Title | Attendance | Number of attendances |

|---|---|---|---|

| Kouji Kawahara | Chairperson Outside Director |

100% | 15 times/15 times |

| Ryo Kawakami | Outside Director | 100% | 15 times/15 times |

| Tomonori Nishimura | Outside Director | 100% | 15 times/15 times |

| Isao Ozako* | Director | 100% | 11 times/11 times |

*The number of attendances after becoming as a member of the Committee

Discussions at the Audit Committee

Major items to be discussed at the Audit Committee include the formulation of the Audit Committee’s auditing standards, the formulation of auditing policies and auditing plans, the evaluation of the content of auditing plans of independent auditors, and the assessment of the selection of independent auditors, and the assessment of the status of development and operation of internal control systems.

Audit Status

The Audit Committee members attend meetings of the Board of Directors and other major meetings in accordance with auditing standards, policies, and plans determined by the Audit Committee. The Audit Committee receives reports or hears from Directors, Executive Officers, employees, etc. on the status of the execution of their duties, and audits the execution of duties by Directors and Executive Officers. In addition to the Board of Directors and Executive Officers Meetings, members of the Audit Committee attend and monitor the Sustainability Committee, the Risk Management Committee, the Compliance Committee, and the Fair Trade Monitoring Committee, which operate internal control systems.

Overview of the Committees

Sustainability Committee

Under an ever changing environment surrounding our Group’s businesses, we are promoting sustainability activities to solve environmental and social issues and enable our Group’s sustainable growth, as well as to realize a “NAMERAKA Society.”

As an advisory body on sustainability activities, we have established the Sustainability Committee, chaired by the Executive Officer (Chief Management Officer of sustainability activities), who is in charge of the ESG Promotion Department. The committee mainly consists of the General Managers of ESG-related departments and deliberates on risks, opportunities, and initiatives related to sustainability. The status of our initiatives is checked regularly as materiality measures associated with risks and opportunities. Risks, opportunities, and initiatives discussed at the Sustainability Committee are reported to the Board of Directors as necessary.

Risk Management Committee

To respond to various risks surrounding the business of the Group, we have established the Risk Management Committee, chaired by the Executive Officer (Chief Management Officer of risk management), who is in charge of the ESG Promotion Department, as an advisory body on risk management to prevent risks from occurring and to minimize damage in the event of a crisis. The committee mainly consists of the General Managers of the Promotion Departments of the risk management. The committee regularly checks activities including identification, analysis, evaluation, and treatment with regard to risks that have a major impact on the management of the NTN Group. The result of discussion at the Risk Management Committee is reported to the Board of Directors and instructions are fed back to the relevant departments.

Compliance Committee

The Compliance Committee, chaired by the Executive Officer in charge of Legal Department (Overall Control Administrator of Compliance Promotion Activities), handles global compliance risks, excluding violation risks of the antimonopoly law and the Subcontracting Act. The committee members are comprised primarily of the heads of related risk management divisions. The committee members formulate and implement risk mitigation measures in cooperation with the Compliance Promotion Activity Supervisors appointed at each business site in Japan and the Administration & Internal Control Department established at each Office of General Manager in five overseas regions, and report to the committee on action plans and the status of implementation. The committee deliberates on the contents of such reports and then reports the findings to the Board of Directors.

Fair Trade Monitoring Committee

The Fair Trade Monitoring Committee is chaired by the President and Executive Officer and consists of Executive Officers in charge of sales and procurement divisions, an Outside Director, external lawyer and so on. In principle, this meeting is held twice a year to discuss the implementation plans and the performance reports for compliance with the Antimonopoly Act and the Subcontracting Act, and to provide supervision and guidance on effective control for fair trade practices along with education and awareness-raising activities. In addition, we have established the Fair Trade Promoting Group in Legal Department as an overall supervisory department for compliance with antimonopoly law. Under the direction of the Fair Trade Monitoring Committee, the Group conducts various activities (such as education, instruction and audit) for relevant divisions in Japan. Additionally, overseas subsidiaries are monitored for the implementation status of compliance with antimonopoly law in cooperation with the Administration & Internal Control Department in each region.

Subsidiary Management System

We have established a subsidiary management system by having its subsidiaries report to the Company on the status of execution of their directors and other relevant personnel and by having them apply to the Company for approval of certain matters through the execution of letters of confirmation regarding business management with subsidiaries in accordance with the Affiliate Company Management Regulations.

In addition, based on the said confirmation, the Company has established an internal control system, a CSR activity promotion system, a risk management system, a compliance promotion activity system, a security export control system, and a system for compliance with competition laws.

In addition, the helpline as a consultation service has been made known to all subsidiaries and is in operation.

Clarify the management system with the “Written Confirmation of Management Control”

・Report on the status of execution by directors, etc. of subsidiaries

・Requests for approval from subsidiaries in accordance with the Authority Rules

・Establishment of Internal Control System

・Establishment of CSR activity promotion system

・Compliance with Risk Management Policy

・Establishment of a system to promote compliance activities

・Establishment of a security export control system

・Guidance and audits of competition law compliance

Compliance with Corporate Governance Code

We are actively working to strengthen its corporate governance, taking into account the intent of the Corporate Governance Code, including the transition to a company with a Nominating Committee, etc., effective June 2019. We have implemented all of the principles of the Corporate Governance Code. In light of changes in the environment in which we operate, we will continue to strengthen our corporate governance.