CSR activities in FY2017

Corporate Governance

Basic Approach and Implementation System

Strengthening and enhancing our corporate governance is one of our top management priorities. We take steps to make management more efficient and robust while securing responsiveness to the purport of the Corporate Governance Code.

Communicating with shareholders, investors, and other stakeholders is another priority. We work to increase management transparency by disclosing information in a prompt and accurate manner.

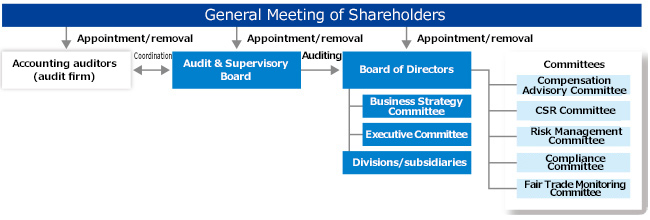

Corporate governance structure

*[ ]Number in brackets below indicate the number of meetings held in the fiscal year ended March31, 2018.

■Board of Directors [18]

Supervises the execution of director duties and decides on basic management policies, legally mandated areas and important management issues. The Board holds regular meetings at least once per month, along with extraordinary meetings whenever needed. It is evaluated to enable improvements to its effectiveness.

■Audit & Supervisory Board [15]

Consists of two standing and two non-standing Audit & Supervisory Board Members. To ensure that business audits are carried out from an independent and objective standpoint, three of the four Audit & Supervisory Board Members are from outside the company. Audit & Supervisory Board audits the execution of director duties, and work to maintain and improve the transparency and fairness of the company’s management supervision system by providing input at meetings of the Board of Directors and other important meetings that they attend.

■Business Strategy Committee [28]

Meets at least twice per month to discuss basic management policies and important management strategies.

■Executive Committee [12]

An executive officer system has been introduced to enable swift decision-making and business execution. The Executive Committee reviews the execution of monthly operations. It is composed of directors, Audit & Supervisory Board Members and executive officers.

■Compensation Advisory Committee [5]

Responds to questions from the Board of Directors by discussing the compensation particulars of individual directors and executive officers, giving back advice and recommendations to the Board. The majority of the Committee’s members are outside officers.

■CSR Committee [2]

Deliberates and implements various measures intended to effectively promote CSR activities. Chaired by the head of the Corporate Value Promotion Department and composed mainly of related department heads.

■Risk Management Committee [3]

Discusses important issues related to the various risks facing the NTN Group. Also formulates Business Continuity Planning(BCP) and implements Business Continuity Management (BCM).

■Compliance Committee [4]

Handles compliance risks not related to Japan’s Act on Prohibition of Private Monopolization and Maintenance of Fair Trade (‘Antimonopoly Act’) or Act Against Delay in Payment of Subcontract Proceeds, Etc., to Subcontractors (‘Subcontracting Act’). Applies a preventive approach to oversee and guide the creation of in-house rules and activities for education, awareness-raising and monitoring.

■Fair Trade Monitoring Committee [2]

Chaired by the President and focused on full compliance with the Antimonopoly Act and Subcontracting Act. Provides supervision and guidance on effective controls for fair trade practices along with education and awareness-raising activities.

Governance-strengthening transition

Compensation Advisory Committee

To increase the transparency and objectivity of director and executive officer compensation, we have a Compensation Advisory Committee that responds to questions from the Board and has a majority of outside officers. The items discussed at the meetings of the Compensation Advisory Committee in the fiscal year ended March 31, 2018 are listed below. They focused on compensation standards, assessments and amounts for directors and executive officers.

■Items discussed at the meetings of Compensation Advisory Committee

- 1st :

-

- Points to award under stock compensation plan

- 2nd:

-

- Director/executive officers summer bonus amounts

- Director monthly compensation amounts

- Investigation of stock compensation plan for following term

- 3rd:

-

- Executive officer winter bonus amounts

- Investigation of stock compensation plan for following term

- 4th:

-

- Director monthly compensation amounts

- 5th:

-

- Executive officer monthly compensation

- Investigation of stock compensation plan for following term

■Attendance record of outside directors/ outside Audit & Supervisory Board Members at meetings of Compensation Advisory Committee

5 out of 5 meetings 100%

Strengthening management auditing functions

To ensure robust management auditing functions, we use an Audit & Supervisory Board Members system with four Audit & Supervisory Board Members including three coming from outside the company. Drawing on specialized knowledge in areas such as finance, management and law, the outside Audit & Supervisory Board Members conduct audits in collaboration with the in-house standing Audit & Supervisory Board Member and the Internal Audit Department. The Board of Directors, which includes two outside directors, decides on important issues and oversees the execution of director duties. The Audit & Supervisory Board Members provide input at meetings of the Board of Directors and other important meetings that they attend. They work to maintain and improve the transparency and fairness of the company's management supervision system. All the outside officers (five total; two directors and three Audit & Supervisory Board Members) are designated as independent officers as defined by the provisions of the Tokyo Stock Exchange, Inc. (TSE). The outside officers submit filings to the TSE. To ensure transparency and fairness, the Board of Directors selects candidates recommended by the company, and appointments are finalized by submission and approval at the General Meeting of Shareholders. Under the provisions of the Regulations of the Board of Directors, votes of the Board are used to appoint and remove representative directors and directors with special titles, and to assign and remove director duties.

Under the provisions of the Management Rules for Subsidiaries, a management control system is implemented by having subsidiaries report issues related to the execution of their duties and having them apply for the headquarters' approval for certain issues.

Outside directors and outside Audit & Supervisory Board Members

We have established standards for independent outside directors and independent outside Audit & Supervisory Board Members that must be satisfied by all outside directors and outside Audit & Supervisory Board Members.

Two of our 14 directors are outside directors. They draw on a broad range of knowledge acquired from extensive experience as managers of other business firms to oversee the company’s management from independent standpoints and provide appropriate advice and suggestions. Input from the outside directors helps ensure management suitability and legal compliance, strengthening the Board’s management decision-making functions.

■Roles required of outside directors

- Taking part in and overseeing the important decision-making processes done by the Board of Directors

- Drawing on a broad range of knowledge gained through extensive personal experience to provide appropriate advice and suggestions on agenda/report items at meetings of the Board of Directors

- Overseeing management from an independent standpoint to improve the common interests of the shareholders

Three of four Audit & Supervisory Board Members are outside Audit & Supervisory Board Members. They draw on a broad range of knowledge acquired from a wealth of experience and long track record as expert financial practitioners, specialist management practitioners or attorneys. They provide appropriate auditing of the company’s business execution from independent standpoints to help ensure ongoing compliance enforcement and improve management robustness and transparency.

As stated previously, five (about 28%) of the total of 18 directors/Audit & Supervisory Board Members are outside officers, helping increase the objectivity and fairness of management oversight.

We send materials related to the Board of Directors’ agenda items to the outside directors and outside Audit & Supervisory Board Members in advance and provide explanations as needed. Especially, for the outside directors, we hold advance briefings on agenda items before the Board meets. At each meeting of the Board, there are lively discussions because the outside directors actively interact with the Audit & Supervisory Board Members and share information.

Audit & Supervisory Board was convened 15 times in the fiscal year ended March 31,2018, and its members met with the Internal Audit Department every month to share and exchange information.

■Attendance record of outside directors/outside Audit & Supervisory Board Members at meetings of the Board of Directors/Audit & Supervisory Board

| Outside Directors | Number of Board of Directors meetings attended (out of 18) |

|---|---|

| Akira Wada | 18 100% |

| Noboru Tsuda | 18 100% |

| Outside Audit & Supervisory Board Members | Number of Board of Directors meetings attended (out of 18) | Number of Audit & Supervisory Board meetings attended (out of 15) |

|---|---|---|

| Kouji Kawahara | 18 100% | 15 100% |

| Tadao Kagono | 18 100% | 15 100% |

| Ryo Kawakami | 18 100% | 15 100% |

Securing Responsiveness to Corporate Governance Code

We take active measures to strengthen our corporate governance while securing responsiveness to the purport of the Corporate Governance Code. We will continue to work on strengthening our corporate governance while adapting to changes in our business environment.